Manuel Arbues, Regional Head at AyalaLand, outlines four trending properties of AyalaLand as follows: Avida Verge, Avida Makati Southpoint, Amaya Skies Cubao, and Amaya Skies Shaw.

He revealed that these four AyalaLand properties have trended among OFWs seeing that these are more affordable projects with payment options that range from only AED 360 to AED 500 per month.

“Yung mga property na ito ay patok sa OFWs primarily because mas affordable itong mga projects na ‘to at napakaganda ng payment term na in-o-offer. May mga stretch sometimes as as long as sixty months, for as low as AED500 or AED360, mayroon ka ng Ayala investment. It’s an Ayala Land investment already and Metro Manila pa yan,” said Arbues.

He also added that the premium locations of these properties at the heart of Manila makes it even more worthwhile and enticing among OFWs to invest at.

“Yung prospect at investment potential nitong mga projects – iyong location is perfect since it’s along EDSA, along major thoroughfare ng Metro Manila. Walang project ng AyalaLand ang bumababa (ng presyo). It’s best to grab the opportunity habang may available pang inventory,” explained Arbues.

He said that since these four AyalaLand properties have been selling fast not just in the Philippines but also among OFWs in the UAE.

“Sobrang ganda ng bentahan – maraming mga overseas Filipinos dito sa UAE ang bumibili dito sa mga projects natin na ‘to. So habang mayroon pa, it’s best na bumili na kayo habang ino-offer pa ng mga developers – ng Avida at Amaya itong mga strecthed payment terms, bilhin na natin ngayon,” advised Arbues.

The eight edition of the Philippine Property and Investment Exhibition (PPIE) has not only showcased investment options for Overseas Filipino workers but also helped them start investing in their personal growth.

In an interactive session, members of the Fil-HR shared tips on how you can accelerate your career. President of Fil-HR Felicito Hernandez and ACC-ICF Credentialed Coach Josephine Dela Paz shared the GROW Model: Goals, Reality, Options and Will.

Through a quiz, they asked the participants to determine their strengths and identify the things that hinders them from achieving their goals.

“The first step is for you to determine your Goal,” said Hernandez. “What will you commit do start doing now?,” he asked the audience.

The next steps are being aware of one’s reality and listing down the options which can help you attain it.

“By deeply understanding who you are what you want to do have or be, you will be closer to attaining your goals,” said Hernandez.

For her part, Dela Paz recommended narrowing down the ways which can help in achieving the said goals.

“Pili ka ng dalawa that will bring you most impact and focus your energy, time and money on them,” said Dela Paz.

The last step is having the will to attain that goal. They highlighted the fact that it all start with having the right mindset.

Hernandez encouraged the attendees by saying that “you can have anything you want if you are willing to give up the belief that you can’t have it.”

Dela Paz also advise OFWs to take action by following a plan.

“The action planning is also important. A plan without an action is… “

Their final tip to OFWs, “Write down your goal. You are the best person to judge your key strengths and do something that makes you feel fulfilled.”

In the post-pandemic era, the Philippines’ real estate market has showed its resilience with property values either staying level – with some properties even reaching higher appreciation amidst the global crisis that sparked the interest of first time OFW investors.

Karlo Jamer, Senior Property Specialist at DoubleDragon Properties Corporation, said that Filipinos nowadays are more conscientious when make investment decisions focused on sustainable, increasing returns over time.

“Return in value is what clients often look for, key located investments that can make returns and weather any business climate,” said Jamer.

Here are the most common considerations and impressions that OFWs feel when they invest for the first time.

Fulfillment. OFWs/First time investors feel more fulfilled when they invest in real estate. For OFWs, real estate provides them the assurance that whatever they invest in has value and will have good returns through capital appreciation.

Stability. Jamer likewise explained that compared to other investment tools, only real estate has been proven to appreciate in its value over the years.

“Having a real estate investment will keep you assured that whatever happens in the economy, one is assured that the investment won’t be highly affected since real estate is one of the safest and usually unharmed,” said Jamer.

Valuable asset. OFWs toil for several years abroad just to give their family a good life. Jamer advised OFWs that the sooner OFWs invest in property, the earlier they can get to reap the benefits of capital appreciation and turn their real estate into something that has value that just increases as time passes by.

“You are assured that by investing now, you are securing that your hard earned money, by turning it into a valuable asset that can provide you and your family security through returns in value,” explained Jamer.

Overseas Filipina women are encouraged to speak up, raise their hands more, and let their voices be heard as top Filipina executives reveal secrets to rise among ranks during the recently-held Philippine Property and Investment Exhibition in Dubai.

The panel, moderated by Dr. Karen Remo, CEO and Founder of New Perspective Media, spoke to four of the UAE’s most experienced Filipina leaders who over the years have found success in their respective line of work as follows:

Know your purpose. Filipino women must find their inner purpose which will motivate them in their line of work.

“You need to know why you’re doing this. It needs to be purposeful in order for you to get up in the morning and really energize and do what you want,” said Penn Policarpio, a Filipina veteran marketing expert during the panel titled: “SECRET TO THE TOP: Take-Aways from Fiipina Leaders’ Tales of Success in the UAE”

She also added that finding your support system and being optimistic will allow you to go a long way.

“The second one is really have your support system professionally or so professionally hire the best so that you can delegate and have some time for yourself and personally you need to have your support system at home. Optimism is also key – always have hope, always know that something is there out for you to strategize for and to move,” said Policarpio.

Take care of yourself. Cleo Eleazar, Public Relations & Events Manager at Ras Al Khaimah Economic Zone, highlighted that women should take care of themselves first before prioritizing the needs of others – and they can do this by managing the 20 percent of life that they can control.

“Concentrate on the 20% which you can control. And then disregard the 80% that you don’t have any control of. Kasi pang gulu lang yun sa buhay natin. This way, you can take care of yourself.

She also added that another way to take care of yourself is by investing in your own capabilities.

“If you want to be successful then you have to be healthy and invest in yourself. Make sure you acquire new skills and invest in property because paguwi natin sa Pilipinas, we all need a home for ourselves. Kailangan natin ng property not only for ourselves sa pagtanda natin and also for our family na din,” said Eleazar.

Avoid ‘BCE’. Women should also stop the ‘BCE’s of life. Roxane Negrillo, Executive Business Director at phd media, quoting inspirational speaker Robin Sharma, said that women should stop blaming, complaining and making excuses. Instead – they should find out what they love to do in life since this will show in the output that they do at work.

“As Filipino women, importante sa atin na we take accountability for our actions and it will also help us become more responsible and more focused on our actions. Importante din sa atin na pursigido tayo kasi ine-enjoy natin ‘yong ating trabaho at siyempre kapag passionate tayo and we love what we do, yung output natin will be high quality,” said Negrillo.

She also added that Filipino women should love what they do and begin investing for their future today in both tangible and intangible matters.

“Also you should invest in yourself under two classifications: Tangible and intangible. Intangible is about upskilling, self-development, and learning new things. For tangible, it’s really important for us to start thinking of investment. Paano natin paghahandaan ang ating future? Hindi naman habang buhay tayo ay OFWs. So importante sa atin na we going to exhibitions like PPIE because it’s credible and alam nating yung hard-earned money natin, mailalaan sa mga trustworthy companies,” said Negrillo.

Be a role model. Dr. Mary Jane Alvero, CEO of Prime Group, stated that women should aspire to be the person they want to work with – to become a role model who will spread positive vibes to the work culture.

“Lagi kong sinisigurado na maging role model ako sa kanila. have done and kung ano pa ‘yong mga natutunan ko. I always see to it na she-share din sa kanila. So that they will learn from me as their leader,” said Dr. Alvero

She added that as a leader, your team will be your support group where you can entrust tasks allowing aspiring Filipino women leaders to grow further.

“I really consider yung team ko na very supportive sa akin. They love me so much and they were able to understand ‘yong lahat ng pinagdadaanan ko as a business leader. Dahil doon sa ganoong understanding and patience nila we were able to move forward and ‘yon ang nagbigay sa akin ng motivation to do more para pag ‘yong aming organization ay lalong lumaki,” said Dr. Alvero.

A panel discussion titled “PAANO BA AKO MAG-START MAG-IPON? Start Saving So You Can Start Investing” during the Philippine Property and Investment Exhibition (PPIE) revealed how some of the Filipino influencers in the UAE save and what are their thoughts on investing.

Moderated by Vince Ang, COO of New Perspective Media, the panel included Dan Lester Dabon, a Multi-Awarded Healthcare Professional, Jay Adrian Tolentino, a Financial Coach, Mico Banua, a Food Guide & Blogger, and Em Serrano, a Food and Lifestyle Blogger.

Dan Lester Dabon shared that throughout his journey as an OFW, he was always encouraged by the hardships that he went through since childhood.

He shared that his investments are all products of the habit of saving and forward thinking.

“You have to think forward lalo na sa mga risks kung ano na yung mga mangyayari,” said Dabon.

Dabon also encouraged viewers to invest in one’s skills and knowledge which can help them earn more, save and invest more.

For Jay Tolentino, any one who is interested in saving or investing must first know what is their purpose.

“It’s a deep questioning in yourself why you’re doing this and who are you doing it for?,” said Tolentino.

“When I meet people, I have to sit down and really ask why they want to invest in this money. Is it an investment of love or is it an economical investment? ‘Pag hindi clear sa’yo ang purpose, there are tendencies na when something new comes around with higher earning, you will withdraw your investment. It’s really important for you to know your why and identify your purpose,” said Tolentino.

For Food and lifestyle blogger Em Serrano shared that she realized the value during the pandemic.

“Doon ko na realize ang importance ng savings kasi ang school po ang unang nagsare, so 6 months wala kaming sweldo noon,” shared Serrano.

Serrano said that she is also a firm believer of the concept of value for money and moderation.

“Pag nagba-blog ako, pag may mura, doon tayo bumili. Para yung sobra, pwede mo pang maitabi. Okay lang gumastos sa pagkain pero wag masyado sa material things. Kung may bagong labas na cellphone, mas gugustuhin ko syang i-save sa bangko para may pang-invest ako sa business,” said Serrano.

Similarly, Mico Banua shared that it’s all a matter of goal-setting.

“Know your goal. Bakit ka mag-i-invest. Kapag hindi kasi strong yung purpose mo, walang value yung gagawin mo. Masasayang lang ‘yung pera mo. So for me, it’s important na mag goal set ka,” said Banua.

Banua shared that as a freelancer, he uses this to motivate himself to grow his earnings at the end of every month.

“I always set a goal. For the first week of the month, I check my clients and may specific goal dapat. Hindi ka magiging complacent. My initial goal is dapat ma-compensate yung sahod ko, pero habang tumatagal, dapat nag-i-increase na rin yung target, gradually,” said Banua.

He encouraged the audience to compete with oneself in achieving more.

The discussion ended with their key takeaway being having a clear vision of what or how much you want to save and knowing why or to whom are you saving for.

The innate culture of ‘hiya’ often hinders overseas Filipinos from overcoming stage fright making them hesitant to speak up and share exactly what’s on their mind – from intimate company meetings and more so in front of hundreds of audiences.

Rico Mondejar, a veteran Filipino motivational speaker and author, said that overcoming stage fright helps Filipinos unlock their potential not just to be more confident to speak up but more importantly, to earn respect, attention, and more opportunities to earn more.

“People will pay you in three ways. First, people will pay you the respect. Second, people will pay you their attention. And third, people will pay you money. Because they want to do business with you, right? So it’s good to stand out,” said Mondejar during his talk titled “SPEECH ANXIETY: Top Tips to Overcome Fear of Speech and Anxiety Among OFWs” in the recently-held Philippine Property and Investment Exhibition.

He outlines that there are several ways as to how Filipinos can overcome their stage fright as follows:

Do your research. When Filipinos are selected to speak for a particular topic, they have to research extensively to gain more knowledge about their topic at hand.

“Una talaga if you are given the opportunity to speak you have to really make a research. Master your topic. Kahit baliktarin ka ‘di ba? If you know the subject matter – you will enjoy speaking.” said Mondejar.

Practice. While there’s no such thing as perfecting your speech, Mondejar said that this paves the way for improvements as you go on and hone your craft: “You cannot reach perfection by practicing but there’s one reality – it makes improvement.”

Grab every opportunity to speak. Mondejar also advised Filipinos to seek ways on how they can speak or even deliver talks in public – whether that’s by joining clubs or meet ups so they can establish rapport from people from different walks of life.

Filipinos make up the third biggest population of expatriates in the United Arab Emirates. It is estimated that the number of Pinoys in Dubai alone is more or less half a million.

During this year’s PPIE, a panel discussion on the Kabayan Power: Top Qualities that Make Filipinos In-Demand in the UAE was held featuring heads of Filipino professional organizations in the country.

Moderated by Chief Operating Office (COO) Vince Ang, the discussion talked about the ways Filipinos in the Middle East can dominate their workplaces and how they can individually utilize their power to start investing.

Chairman of the Philippine Institute of Certified Public Accountants (Dubai) Lyndon Magsino shared during the discussion his 3 C’s of success which are: (1) Communication, (2) Confidence, and (3) Collaboration.

“How to be successful in your chosen field: First is communication, it is very important that you have to have communication skills to be able to convey your message clearly to your direct reports, to your line managers, to your peers. Next is confidence, confidence comes from people, experience, and learning. Never stop learning. Collaboration for me is building relationships. A lot of people are getting into the corporate politics, try to avoid that,” said Magsino.

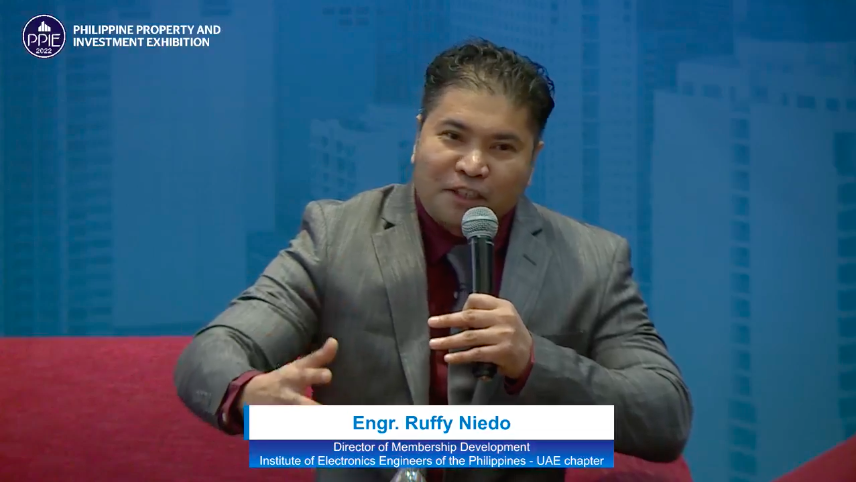

Meanwhile, Director for Membership Development of the Institute of Electronics Engineers of the Philippines – UAE Chapter, Engr. Puffy Niedo, shared how having a backbone organization or a supportive community can help unleash the real power or potential of Filipinos, especially those who are aspiring Engineers.

“Even if you are undergrad here in the UAE, you can still continue studying here in UAE and take the exam. The PRC comes here and helps out to help you get certified,” said Engr. Niedo.

He encouraged those who are already earning an average of 5,000 dirhams to invest in honing one’s skill even more and attain the supposed salary of professionals in UAE which is at 20,000 dirhams.

“Being an Engineer, technology is developing exponentially, kaya ayan po ang tinatarget namin. Subasabay po tayo, nakkipagsabayan po tayo. So, that is the mission of IECEP, that’s why we are here. Marami kaming ginagawang activities. We want to change their mindset. They are contented that they have a salary of 5000 that is very enough. You can family you can being here pero i told them not to stay or be content with that salary. Why? because your level of success as a technician can lead you to earn and reach the minimum salary of up to 20,000 dirhams,” said Engr. Niedo.

For his part, Magsino said that he prefers diversifying his earnings to various investments.

“I diversified my investments in real estate, stocks, I do crypto on a very minimal level, and bonds,” said Magsino.

He said that as professionals, we should also look into equipping ourselves in terms of financial literacy.

“Majority of our events and seminars is actually not technical. We are already graduate in those kinds of topics. I like the liquidity part of stock market. You have the ability to sell and buy anytime. For example, if you need 5 million, you cannot just get a buyer of your lot or condominium today. But in stock market, right now, there are hundreds who would like to have my shares. If you want your funds today, right now, you can just simply trade in the Philippine Stock Exchange or even in the US. I diversified my investments in real estate, stocks, bonds,” said Magsino.

He inspired the crowd by sharing that he was able to recently purchase a property in Dubai worth 3 million just through the earnings of his investments in the Philippines.

“This proves that the real estate market in the Philippines is thriving and profitable,” said Ang.

Likewise, Engr. Niedo also shared that even his purchased property in the Philippines has already increased in value regardless if it has not been updated or is currently not being utilized.

They encouraged other overseas Filipinos to have an open mind into when in comes to learning about investment and believe in their ability to also achieve the same positive results.

Every month, one of the regular activities among overseas Filipinos is a trip to their preferred remittance center to send financial assistance to their family. And while those can easily be tracked through pen-and-paper budgeting, the Bank of the Philippine Islands (BPI) has offered a bank account called ‘BPI Pamana Padala’ dedicated to OFWs which will help them manage their finances better.

Randall Asejo, Relationship Manager and Marketing Expat at Bank of the Philippine Islands, said that BPI has created the BPI Pamana Padala account that caters specifically for OFWs who want to both manage their finances in the Philippines and streamline their family’s spending habits at the same time, with a lot of benefits in tow.

“This is an account exclusive sa mga OFWs. Zero maintaining balance ito. Upon opening meron po kayong 90-days insurance coverage and may libreng life insurance na nakadepende po sa amount na hinulog ninyo for the past 12 months,” explained Asejo during his keynote speech titled “Buhay Asenso sa Bawat Padala” at the recently-held Philippine Property and Investment Exhibition.

“We highly recommend or suggest na kung magpapadala kayo sa papunta sa inyong BPI account, doon po kayo sa aming mga remittance partners,” he added.

OFWs based in the UAE can easily visit BPI’s representative office in Dubai at Shop no. 1, Al Diyafah Bldg, same side with Carrefour opposite Hana Center – Al Mankhool Rd – Dubai to create an account, inquire about home loans as well as other services.

Requirements include:

– Original valid ID with photo and signature

– Proof of OFW Status

– Peso/US Dollar Deposit

– The applicant must be between 18-55 years old

The BPI Pamana Padala benefits for OFWs include a remittance continuation plan; a free 90-day personal accident insurance with up to Php100,000 coverage; and free life insurance provided the OFW sends four remittances per year. The life insurance has a coverage of up to Php 300,000.

For more info, visit: https://www.bpi.com.ph/pamanapadala

One of the primary questions of Overseas Filipino Workers (OFWs) when starting to make sure that their hard earned money don’t go to waste is whether they should save or invest any extra of their income.

Experts during the Philippine Property and Investment Exhibition (PPIE) shared during a panel discussion the difference between saving and investing and relayed their personal experiences which can help OFWs to either choose one or do both.

The talk titled ‘SAVINGS vs. INVESTMENT: Huwag Sayangin Ang Pinagtrabahuhan. Maging Wais Sa Perang Pinaghirapan!’ was moderated by General Manager of New Perspective Media, Vince Ang.

Among the panelists were Agnes Marelid, Owner and Founder of Mid Night Sun MNS Corp and Honey Rivera, Marketing Specialist of Motor Mazad.

Speaking in front of the audience, Agnes shared that if there’s a headline for her current life status, it is the fact that she is now able to enjoy the fruits of her labour.

“Nagbunga na, yun ang bago kong headline ngayon. We started in 2012 and we are already renting out those properties. I’m a living testament na investment in real estate really work,” said Marelid.

Meanwhile, Rivera shared that her journey in the real estate began with her childhood dream of owning a hotel.

“I started with staycation business so when I invested in a property and when it was going so well, my friends and clients in Australia and Hong kong wanted me to manage their properties.

Ang said that both types of properties for rent have really good justification. He asked both the panelists how can one start saving or investing.

Marelid said that it is a matter of knowing which works for you.

“First of all, we need to differentiate saving from investment. Nung maliliit pa tayo diba, mayroon tayong alkansya o piggy bank. So were always encouraged to save para pag kailangan mo, meron kang pera. We always think na when it’s savings, automatically it’s in the bank. And in investment, it’s always about buying something. And you expect that something to grow or to multiply or to give you income,” explained Marelid.

The best way according to Marelid is to set your finances straight is getting into the habit of saving.

“You set from the early age ways of thinking about savings. You can also save for investments. There is no big difference kasi yung parang nilaan mo pwede mo ring gamitin for investment later,” said Marelid.”

She shared that her first investment in 2012 is now earning and is her source of passive income.

“My first investment in real estate in the Philippines was through Ayala Land, a unit in Zecoya which I purchased in 2012. That is our very first real estate investment,” said Marelid.

She also highlighted the importance of finding a trustworthy broker, especially if you are an OFW living far away from the Philippines. Marelid shared that she is thankful to her broker for guiding her as to which investment she should go for first.

“You have to create that personal relationship with your adviser,” said Marelid.

In her experience, her broker recommended a ready-for-occupancy property and was able to find tenants for her unit within 6 months, allowing her to go worry-free and earn monthly quickly.

“RFO na yung unit and within 6 months, Napa-air bib ko na sya. I’m not advising na its not get rich quick. Pero in my experience, in 6 months, kumita na ako,” said Marelid.

For her part, Rivera shared that her desire to own a property began in 2013, a year after she was renting a property.

“I was hesitant to invest before. But in 2013, I realized that it was a mistake because of the annual property valuation. Kasi the year after, the property’s value increased already. That was the start. ,” said Rivera.

Rivera admitted that she is not the type of person who saves money. For her, investing now is the only way to get the benefits of real estate.

Honey Rivera, Motor Mazad

“Im not really a ‘saving’ person because there is no right time for investing. In saving, the money that you are keeping does not have a guarantee that it will still be in tact. There will come a time wherein you’ll be forced to use that money. Not unlike if you started investing in a property, you have the obligation to be responsible because you have that monthly mortgage that you need to pay,” said Rivera.

Marelid agreed with Rivera and said that “not all of us are gifted to be savers.”

“I live for a while in Sweden and I was married to a very frugal Swede. Talagang tinuruan nya ako na don’t buy something you don’t need. Just because you want it, honest mean you have to have it. Parang na-institutionalize ako sa Sweden na you don’t have to have the most expensive things in the world. There could be other things have a better life in the future,” said Marelid.

She personally revealed giving up designer bags for the sake of investing in a property.

“For example, yung binili namin sa Ayala, yung first unit namin, pinaghirapan ko yan sa Sweden. Marami akong ginive-up na Louis Vuitton bags na ‘yan. Marami akong ginive-up na trips around the world, just to be able to pay for a downpayment for that,” said Marelid.

Now, Marelid enjoys being the head of her company Mid Night Sun MNS Corp which works on offering the best real estate option or leasing of both premium and affordable properties in the Philippines.

Rivera, who now handles several properties said as a top for first time investors that they should first look for the location and amenities

“Because you know, the people who wants to stay there they want to liv the life with the same location that where they are staying. But for me, in that time when I was looking for the location. It was the target audience,” said Rivera.

She said it’s important to put your shoes in the position of your clients. Do you wish purchase for your family, is your target markets couples or will you use it purely for business?

Rivera said that it is for that reason that she first invested in a family home.

Ang commended Rivera’s tip saying that the unit being offered as a passive income should not cater to the unit owner but to his or her target market.

“Aminado tayo dyan. Minsan nag-iisip taro ng business ang naiisp pa lang nating customer yung sarili natin. Kung ano lang yung gusto mo pero hindi mo na-isip yung target mong customer,” said Ang.

The two concluded the discussion by reminding the viewers of the perks of knowing how to save and invest as soon as possible.

Overseas Filipinos who are planning to launch a business in the Philippines are urged to take advantage of financial assistance from the Philippine government for budding entrepreneurs, and to participate in the government’s array of livelihood seminars, which are provided free of charge and are often live streamed through Facebook.

The Department of Trade and Industry’s Commercial Attache in the Middle East Charmaine Mignon Yalong said that the DTI, through the Philippine Trade and Investment Center (PTIC)-Dubai regularly holds mentoring sessions that are available for free through their official Facebook page: https://www.facebook.com/DTI.Dubai/

“This is all part of our program which is ‘Trabaho. Negosyo. Kabuhayan.’ In general that’s how summarize the mandate of DTI. Gusto naming magbigay ng trabaho, tumulong sa negosyo at mag-improve ang kabuhayan,” explained Yalong during her talk titled: “Serbisyong OFW: Financial Assistance Projects for Returning OFWs” during the recently-held Philippine Property and Investment Exhibition.

She added that the DTI hopes that more overseas Filipinos could jump in the entrepreneurship bandwagon as this will help not just the Filipino who will earn from her/his business, this would also ripple to benefit the Philippine economy by creating more jobs, thereby providing income to even more Filipino families.

“We believe in DTI na the way for the Philippines to increase jobs and to have more income is to promote entrepreneurship. Sa Philippines, 99 percent of our businesses are MSMEs so we really have to support our Micro, Small, and Medium Enterprises. In the Philippines’ Ambisyon 2040, we want a prosperous middle class society where no one is poor and our people will enjoy long and healthy lives,” explained Yalong.

Yalong likewise stated that DTI provides guidance as to which types of funding the OFW could avail, provided that the business that the OFW is planning will be based in the Philippines.

“Marami pong government agencies that can provide funding for aspiring entrepreneurs. May mga loans na pwede mong ma-avail specifically for returning OFWs. So iyon kailangan nag-‘for good’ ka na. Pero there are other loan facilities where you don’t have to be based in the Philippines pero what’s key is that the business has to be in the Philippines,” said Yalong.

Those who would like to inquire about getting financial assistance for Filipinos entrepreneurs who wish to launch their business in the Philippines may send an email to: [email protected]