Projects like lakeside developments can provide investment opportunities for OFWs and a peaceful home post-retirement

To cater to the changing demands necessitated post the Covid-19 pandemic and anticipating economic development, Sta..Lucia Land Inc. (SLI), a leading property developer in the Philippines has been setting its sights on countryside development, especially in the emerging cities and provinces.

These developments like lakeside communities in the calm and picturesque areas offer attractive investment opportunities for Overseas Filipino Workers (OFWs) in the UAE. It is also an attraction for the OFWs who want to lead a peaceful life in the countryside of the Philippines after retirement and at the same time enjoy the comfort of living by staying abreast with the latest technologies.

“The metro is getting congested year after year and with huge government infrastructure projects undertaken in various areas in the Philippines, we believe this is where the new growth areas are. In the north, for instance, New Clark City is going to resume its development after being halted by the pandemic and the opening of the new Clark Airport recently has already influenced major businessmen to consider relocating or establishing a hub in the north. In the south, on the other hand, several highways and road networks are nearing their completion which could catalyse economic development.

Although, Sta. Lucia has been present in the area for decades now but we believe there is still a lot that can be done,” Miguel Bilan, International Sales & Operations Manager, SLI, said in an interview.

Sta. Lucia is targeting the OFWs for investment in their residential projects. OFWs are the major investors in their projects and the developer has established an office in Dubai and other major cities throughout the world where there are significant communities of Filipinos to push their sales.

“OFWs comprise the majority of Sta. Lucia’s property buyers. They have been one of the major reasons why the Philippines real estate industry as a whole had flourished enormously for the past decade or so. It is for this reason that Sta. Lucia embarks on a major decision to establish its sales and marketing offices abroad to cater to the OFW market. A strong social media presence and extensive online marketing efforts are a must nowadays to capture the OFW market,” Bilan said.

SLI is counting on property buyers including OFWs who love to maintain the right balance of being able to enjoy life’s conveniences while at the same time communing with nature and being pampered by its calming vibe through its most favoured development projects – Lakeside communities.

“Properties that are in close proximity to nature and have available wider parks and open spaces have been in demand since the start of the pandemic. These types of properties allow owners to enjoy a holistic lifestyle that is essential to one’s physical and mental health which have been a major concern during the pandemic. Because of this, our farm and residences and lake community projects have been selling very well up until now and we believe this trend will continue in the next foreseeable future,” Bilan said.

Currently SLI has nine of these developmental projects namely; Green Meadows Iloilo; The Lake at St. Charbel in Dasmariñas, Cavite; Catalina Lake Residences in Puerto Princesa, Palawan; La Alegria in Silay City, Negros, Occidental; Catalina Lake Residences in Bauan, Batangas; Los Rayos in Tagum City, Davao, Las Colinas at Eden in Toril, Davao City and soon Catalina Lake Residences in Orion, Bataan.

Following this trend, Sta. Lucia is preparing to offer more of this kind of projects in Rizal, Laguna and Batangas. The property developer is also offering flexible payment plans to attract more investors.

“We understand that a lot of prospective property buyers are a bit reluctant to invest even up to this day because the pandemic is not over and some are still recovering financially from the pandemic. Because of this, Sta. Lucia is offering flexible payment plans that could allow interested buyers to pursue their investment at a much more affordable monthly payment,” he said.

SLI reported a net income of P2.84 billion last year, up 66 per cent from 2020. Gross revenues were 24 per cent higher at P8.37 billion than the previous year.

“Property buyers’ interest started to bounce back starting in the second half of 2021 and as reflected in the significant increase in the number of inquiries and website visits. Sales have also improved compared to the preceding year.

This 2022, the company is very optimistic to achieve even higher sales turn-out compared to the last two years as we return to normalcy. In the first half of the year we have launched the expansion of our residential project on Rizal and a new project in Bataan – both projects are well received by buyers as initial sales take-ups are impressive.”

With more than 250 projects located across Luzon, Visayas and Mindanao, Sta. Lucia assures its buyers that there is a project that would suit the buyer’s requirement whether it is in terms of cost, location or property features.

The Philippine Property and Investment Exhibition (PPIE), the biggest, longest-running and most trusted Philippine business and investment forum in the Middle East, is now on its eighth edition, which will be held this 2022 at Crowne Plaza – Sheikh Zayed Road.

The past seven PPIE editions made history in the UAE and the Gulf region by bringing in over 24,500 quality visitors.

Overseas Filipino Workers are often accustomed to grow their money through a savings account – however, the risk of inflation carries with it the notion that the money you might save today might not be sufficient for tomorrow’s needs. While saving cash that you can grasp and withdraw at any time is might be ‘safer’, it’s unlikely to have any other opportunity to grow since it’s sitting on the bank.

This is why more and more OFWs are exploring different kinds of investment tools – in order to obtain an additional source of income or gain profit over a specific period. Two popular options are stocks and mutual funds both of which allow investors to build their wealth portfolio over time.

Vanessa Galvez, Assistant Vice President at First Metro Securities, urges overseas Filipinos to take advantage of the ongoing slump in the stock market since data suggests that despite some downturns, the Philippine Stock Exchange index (PSEi) remains resilient and is still on an upward trend for the past 25 years.

“In stocks, time is your best ally. Take this slump as an opportunity to buy good companies. Imagine, going to a mall and seeing your favorite brand at 20% to 40% off, wouldn’t you buy? The same is true with stocks now. Stocks like Ayala Land Inc. now at 31.75 is 38% down from its pre-pandemic price of 50.80 (June 2019). And there are a lot more stocks now that are at least 20% cheaper that their previous price,” advised Galvez.

If you are an Overseas Filipino Worker (OFW) and want to add to your income and secure your future, here are several reasons why you should consider investing in stocks and mutual funds as your investment option:

Affordable: Numerous stock brokers allow opening an account of a minimum of PHP 5,000. Many stocks pay dividends, which are payments made to shareholders out of the company’s profit, and they’re typically paid quarterly.

In mutual funds, you can start investing with only PHP 1000 and then make subsequent investments for as low as PHP 1000. You can inculcate discipline to invest regularly with a Systematic Investment Plan (SIP).

Access to money during investment: Most investment funds offer high liquidity, making them an ideal option for investors who want to be able to access their money at all times. Liquidity means the ability of an asset to be converted into liquid cash. But remember, if you withdraw your money before the recommended time horizon, you could increase the risk of getting back less than you invested. Whenever you assume greater risk in your investments, you should think about the long term to reduce the risk of possible losses during downturns in the market.

Diversification: It is the best way to reduce risk in an investment. Funds are invested in a wide range of stocks, and financial outlets to minimise risks, i.e. interest rates, market prices, etc. There is little chance of all instruments not growing to their potential and thereby making your investment safer. Not everyone has enough money to invest in a wide range of products, but even if you can only acquire two or three products, make sure there is some degree of diversity.

Beneficial and secure: Investment funds have the greatest potential for growth (capital appreciation) over the long haul. Investing in stocks and mutual funds is regarded as a beneficial and secure way of trading. Stocks can be a valuable part of your investment portfolio. Owning stocks in different companies can help you build your savings, protect your money from inflation and taxes, and maximise income from your investments. There are risks involved and your tolerance for the risk makes you stand out amid rapid fluctuations in the market.

Expert advice available: An investor with long-term plans gets experienced with time and also relies on technical analysis from stock market experts. Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analysing statistical trends gathered from trading activity, such as price movement and volume.

“We all grew up being told by our parents that properties are the best investment. While that may be true, not many have the millions to buy land or condos. So, while working on that, why not spare just P5,000 to invest in stocks now? It’s low cost, easily accessible, and grows over time as well. This time may be scary to some. But you can make the wiser choice. Instead of being fearful, take advantage of this opportunity. Invest now and let it grow over time,” said Galvez.

How can I start?

With online trading platforms, Filipinos can buy stocks through the PSE. Some brokers allow OFWs to open a trading account without a personal appearance. Applications with supplementary documents can be sent via courier and they fund your account via wire transfers.

For mutual funds, you can open an account through a mutual fund company, registered investment advisor, stockbroker, bank or any other financial intermediary after completing your KYC first time. It also requires a personal appearance to open an account but if you have already a savings account with a Bank in the Philippines, you can have the option to have a trading account online.

It is recommended by experts to start early for long-term gains. Select an online stockbroker, research the stocks you want to buy, decide how many stocks to buy, choose your stock order type, and optimise your stock portfolio.

How can I avoid investment scams?

Stocks in public companies are registered with the Securities and Exchange Commission (SEC) in the Philippines and in most cases, public companies are required to file reports to the SEC quarterly and annually. Annual reports include financial statements that have been audited by an independent audit firm. Information on public companies can be found on the SEC’s EDGAR system.

For us Filipinos, insurance is still considered the least popular choice of investment. This is due to many reasons. Many of us stated that we are still hesitant to invest in insurance because we don’t have enough money. Many want to leave it to fate as they don’t understand insurance terms, which are normally difficult to understand. Some people feel they are healthy and have a lot of time and will need insurance only when they are about to die. The most challenging part is that people consider insurance a scam, a waste of money, and not a means of investment.

Investment in generating returns is the key to building wealth. As you try to evaluate different investment plans, you might wonder whether insurance is a worthwhile investment.

Insurance is a means of guaranteeing protection and safety. Protection can primarily pertain to your life, health, money, property, education, travel, vehicle, and business. It protects you from unplanned and sudden situations like death, accidents, thefts, etc. Insurance is an investment, not an expense. Insurance is beneficial for everyone, as it helps offset costs for a lot of expenses, from school fees to medical bills. Among all things, life insurance is a popular investment as it provides both financial security and financial growth.

10 reasons why OFWs should invest in life insurance

1. Life Insurance comes with low premiums

OFW’s primary reason for working abroad is to take care of their loved ones, especially by looking after their financial needs. To ensure that you will be able to secure your future financial needs, life insurance is something you may consider adding to your financial plan if you are interested in providing a measure of security for your loved ones. Premium payments are usually low, and proceeds from a life insurance policy can be used to pay final expenses, eliminate outstanding debts, or cover day-to-day expenses. It can also fulfill philanthropic goals after your death, as benefits can be passed to your favourite charity.

2. Secure your loved ones

We, as Filipinos are known to say, “bahala na”, hoping that things will have a better result. Leaving everything to fate could prove costly for your loved ones. Living in the present is good, but thinking about the future is also equally important. An accident or an untoward incident can befall at any time. Life Insurance takes care of financial problems your family might face in the event of an unfortunate event that occurs to you, like a fatal accident or sudden death. Understand the terms of insurance by reading it many times and taking the help of financial advisors and sales agents to explain hard-to-understand concepts. Getting insured now will protect your future.

3. Health insurance is not enough

Many Filipinos are averse to even health insurance as they consider themselves healthy. However, Philippine citizens, especially employed people, are majorly covered under Phil Health (Philippine Health Corporation, which implements universal health coverage) or HMO (Health Maintenance Organisations). They ensure the majority of the medical bills are covered in the event of an accident or chronic disease. But both of these health insurances offer assistance only for health emergencies. They are different from life insurance.

4. The advantages of starting early

YOLO! as the majority of Filipinos would describe their way of life. We tend to think that we still have time for everything. However, it’s different when it comes to insurance. You may be younger and healthy, but if you opt for a life insurance policy at a young age, you get more coverage and higher returns. The cost of getting a life insurance policy at a young age while you are in your mid to late 20s can be lower compared to when you get insurance later in life. This is because, by this age, one would already have enough income to support current needs and a little extra to invest in future needs. The policy will also secure your family in case of any eventuality. The decisions you make today will affect you tomorrow.

5. Insurance with investment options

Many life insurance products also offer investment options. If you love risks, you opt for potentially high returns governed by stock market movements. Some insurance plans guarantee a sum assured. Such plans keep your money safe from market conditions. Reputable insurance companies also offer bonuses, helping your investments grow. The returns from life insurance plans can help you meet your life goals, such as children’s higher education, marriage, and financial freedom after retirement.

Payout is determined by the performance of the underlying securities in the policy. Variable life insurance policies are considered more volatile than standard life insurance policies and are ideal only for those who take additional calculated risks.

6. There are many accredited insurance companies

Scammers are just around the corner, even in the insurance industry, so it is just normal for people to think twice before taking insurance. The insurance industry in the Philippines is regulated by the insurance Commission and only licensed agents and advisors are allowed to sell insurance and investment products. It is recommended to do some research before selecting an insurance agency and transact with agents and advisors from credible and accredited insurance companies.

7. Financial Security

Traditional life insurance, also known as whole life insurance, money back insurance or endowment insurance, provides multiple benefits like risk cover, fixed income returns, and safety. These are considered risk-free on account of their fixed returns in case of death or maturity of the term. It never runs out, and upon the inevitable death of the contract holder, the sum of money assured to a policyholder when a claim is accepted (Payout) is made to the contract’s beneficiaries. It gives you and your family financial security in emergencies and prepares you for unforeseen expenses. These policies also include an investment component, which accumulates a cash value that the policyholder can withdraw or borrow against when they need funds.

8. It instils the habit of saving

A lot of us couldn’t start on any investment because it seems expensive, however, insurance allows you to start on investment with a very minimal amount. Since you need to pay the life insurance premium amount on time to keep the policy in force. This creates discipline in payment and inculcates the habit of saving in you, as you want to spend less to make sure premium payment is ready on time. This motivates you to save more and build up the funds for your future needs. Late payments can result in the termination of the benefits and coverage provided under an insurance policy by the policyholder (lapsation).

9. Saving on Income Tax

You can claim tax relief up to a certain level based on the premiums paid for your life insurance and health insurance policies.

The proceeds from life and health insurance are not usually part of the gross income and are hence can be exempt from taxes. These benefits, not generally found in other investment products, can reduce your income tax liability and increase your savings.

10. Peace of mind

Life Insurance gives you peace of mind as the needs of your loved ones will be met in case of any emergency. It safeguards your family against economic challenges in case of an eventuality. If used properly, it can also help you achieve financial stability. Insurance may not be a direct investment product, but it is an essential tool you should include in your investment portfolio.

Overseas Filipinos can now live a life akin to New York’s luxurious towering peaks fused with the serenity of lush greeneries back home in the Philippines, thanks to the Grand Central Park North BGC, established by premier real estate corporation Federal Land.

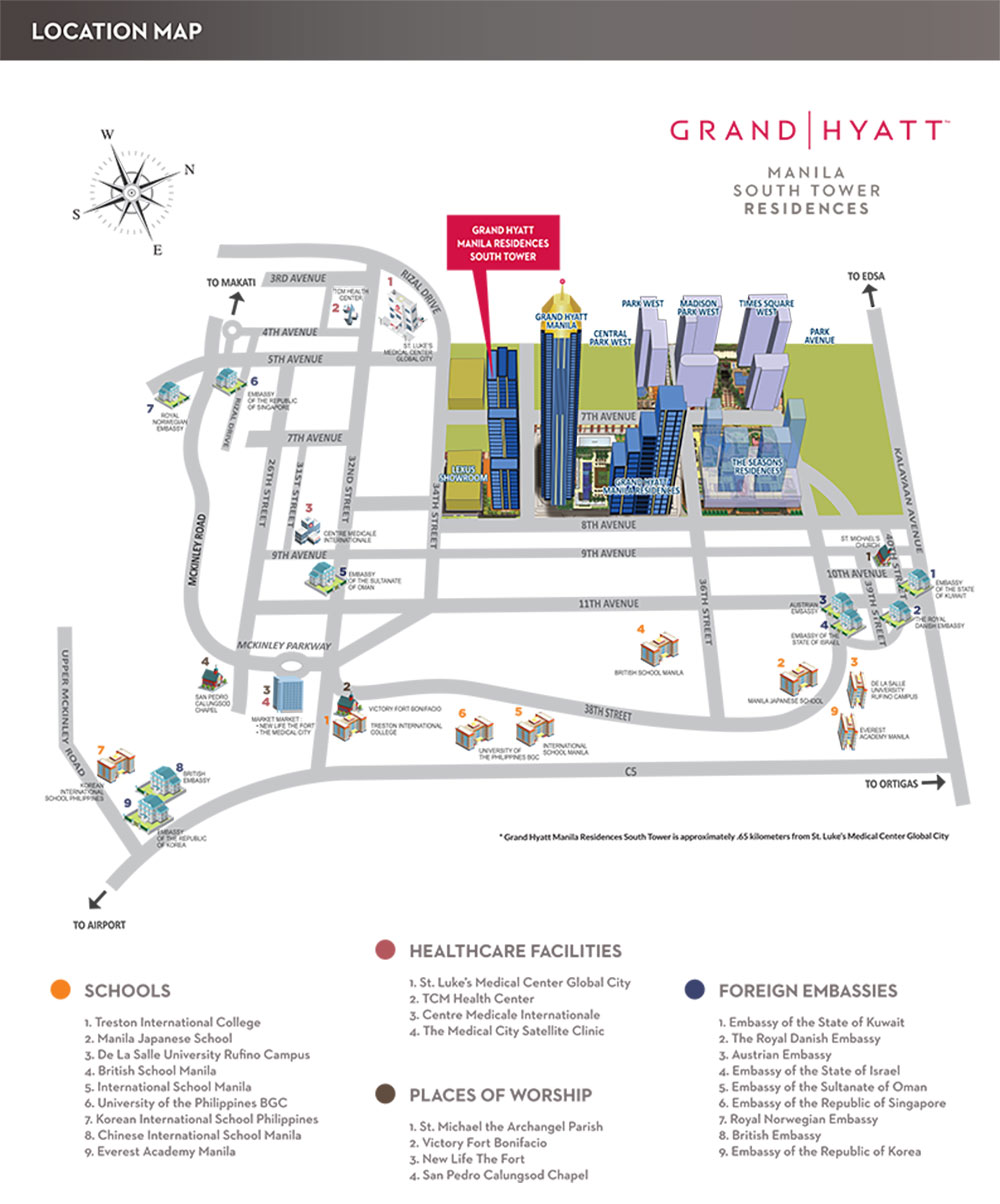

Grand Central Park is strategically positioned in North Bonifacio Global City, at the confluence of two developing cities, Taguig City and Makati City. This 10-hectare, New York-inspired master-planned community, offers one-of-a-kind venues for living, working, shopping, and dining that are devoted to promoting a well-balanced existence.

It is now easily reachable as well, thanks to the newly-launched BGC-Ortigas link road, making it ideal for anyone from urban professionals, on-the-go business owners, and even for families with kids who have to go to any of the Philippines’ premier universities.

OFWs planning to own a condo in this area can take advantage of the pre-selling phase for the Japan-inspired ‘The Seasons Residences’, which also houses the Philippines’ first-ever Mitsukoshi Mall; or live adjacent to one of the tallest skyscrapers in the country – the Grand Hyatt Manila. Interested property investors can opt for either the Grand Hyatt Manila Residences which is almost sold out as of posting time, or the Grand Hyatt Manila South Tower Residences, which is currently in its pre-selling phase.

In addition, Federal Land has several ready-for-occupancy condo projects in this area, including Park Avenue, Central Park West, Madison Park West, and Times Square West.

The hotel and condos are the focal point of Grand Central Park North. The district of Bonifacio Global City (BGC) is peppered with art, plazas, and parks, and world-class health, commercial, educational, and cultural institutions are all within walking distance.

Meet Federal Land Inc. at the 8th Philippine Property and Investments Expo (PPIE) on 5-6 November 2022 at Crowne Plaza Hotel in Sheikh Zayed Dubai. Federal Land Inc. is a silver sponsor of PPIE, the biggest, longest-running and most trusted Philippine business and investment forum in the Middle East, now on its eighth edition.

The past seven PPIE editions made history in the UAE and the Gulf region by bringing in over 24,500 quality visitors.

Buying a home is one of the most significant purchases a person can make in his or her lifetime. It has always been an aspiration for overseas Filipino workers to be able to afford and live in their own home. When they tell others that they have managed to secure their own home, it gives them a sense of pride and accomplishment.

Worthwhile investment. The majority of Filipinos who became OFWs did so because they wanted to earn more money and better their families’ lives. Home ownership is becoming a reality for them as their financial situation improves. This is why many OFWs set aside a portion of their hard-earned money for the purchase of real estate. Whether as an investment or as a primary residence, it is bound to appreciate over time.

Alternative source of income. Purchasing a home, particularly a condominium, can provide the OFW with a source of income in the form of rent. It could also become their permanent residence if they decide to retire. A number of banks, through their financing programs, can assist an OFW in making the right decisions when it comes to real estate investment. These worthwhile investments, however, require a significant amount of time and money. Whether it’s a car, a child’s education, a business, or, of course, a home. With proper financial advice, an OFW can learn to set aside his hard earned money on a regular basis for the purchase of real estate.

Capital appreciation. OFWs must also be made aware that investing in real estate is worthwhile due to the high likelihood that it will appreciate over time and even generate an income if the OFW decides to rent it out. It should be regarded as a dream realized for an OFW who has managed to save enough money to provide a home for himself and his family after working overseas and overcoming obstacles.

The Philippine Property and Investments Expo (PPIE), the biggest, longest-running and most trusted Philippine business and investment forum in the Middle East, is now on its eighth edition, which will be held this November 5-6, 2022 at the Crowne Plaza – Sheikh Zayed Road.

The past seven PPIE editions made history in the UAE and the Gulf region by bringing in over 24,500 quality visitors.

Funding your initial down payment, as one of the first steps in the home-buying process, might look difficult at the outset. In general, the larger the down payment, the less the individual must pay in monthly installments for the remaining amount. Anyone may easily save for a down payment and realize their goal of purchasing a home with the right kind of planning. Here are some ideas to help you start saving for your down payment.

1. Open a savings account. Regular saving, while difficult, is the most effective strategy to keep on top of your money. That is why the first and most critical step in saving for a down payment is to open a savings account into which you may put your funds. One of the strategies is to have a separate account where you can set aside money immediately when your salary comes. This way, you may ensure that your savings are directed toward what is most essential.

2. Keeping your expenses under control. In addition to saving consistently, it is essential to live within your means and spend appropriately. To begin saving, you should pay off any credit card debt. You should also prevent any unneeded purchases or expenditures wherever feasible.

3. Seek professional assistance. While you should do your best to properly organize your money and save as much as possible, you may also seek guidance from specialists. Seek out a qualified financial planner who is an expert in the market to ensure you are on track to meet your savings objectives. They can assist you in identifying the actions you need to follow in order to save for a down payment in the nation where you are purchasing a property.

By following these suggestions, you may ensure that you are on the right track toward saving for your down payment. Planning ahead of time is essential for making the process smoother, and it is never too early to begin saving – so begin now and keep working toward your dream of buying your own house.

The Philippine Property and Investments Expo (PPIE), the biggest, longest-running and most trusted Philippine business and investment forum in the Middle East, is now on its eighth edition, which will be held this November 5-6, 2022 at the Crowne Plaza – Sheikh Zayed Road.

The past seven PPIE editions made history in the UAE and the Gulf region by bringing in over 24,500 quality visitors.

DoubleDragon Properties aims to acquire its first property outside the Philippines by the second quarter of 2022 which will be developed into a Hotel 101 concept, as its flagship project marking the first international venture for the company.

The first Hotel 101 project within the Asian region, slated to be launched at the latter half 2022 in Singapore, is also planned to provide Filipino investors with an opportunity to make their first overseas real estate investment with flexible payment options for their hybrid condotel Hotel 101 venture.

DoubleDragon Chairman Edgar “Injap” Sia 2nd is optimistic that Hotel 101’s hybrid condotel concept will be well received by the international community for its pioneering approach.

“Filipinos are admired all over the world for being highly hospitable people. In fact, many hotels around the world are ably handled by Filipino talents. With that in mind, DoubleDragon believes it’s about time that a Filipino company pursues that aspiration of creating a homegrown Filipino hotel brand that is recognized globally and will eventually bring honor and pride to Filipinos,” said Sia.

DoubleDragon Chairman Edgar “Injap” Sia 2nd

DoubleDragon has also identified locations where Hotel 101 is likely to be visited by local and foreign visitors, as well as Filipinos visiting the country for business or pleasure, as per reports from The Manila Times.

“We are grateful to the DoubleDragon team who have, over the years, been able to put together, polish and test the unique and pioneering Hotel 101 hybrid condotel concept and most especially put to life an exportable concept for the world. We are also glad to have been able to file the Hotel 101 concept patent early on,” added Sia.

The Hotel 101 idea is a hybrid condotel model in which all units, or “Happy Rooms,” as they are known, are identical, enabling all unit owners a part of the Hotel 101 property’s income. Each unit owner enjoys 30% of the gross revenue and owns the title to the unit, with free nights across Hotel 101 projects nationwide. Hotel 101 gets 70% of the gross room revenue but will ensure occupancy and handle costs such as unit fit-out, hotel operating expenses, unit repairs, and maintenance.

“The development and completion of these new Hotel 101 projects will be perfectly timed with the full recovery and anticipated rebound in the tourism industry. We believe in a couple of years, all this pent up demand for tourism will cause an unseen surge in demand for hotel rooms across the globe,” said DoubleDragon Chief Investment Officer Hannah Yulo-Luccini.

Meet DoubleDragon Properties Corp. at the 8th Philippine Property and Investments Expo (PPIE) on 5-6 November 2022 at Crowne Plaza Hotel in Sheikh Zayed Dubai. DoubleDragon Properties Corp. is a silver sponsor of PPIE, the biggest, longest-running and most trusted Philippine business and investment forum in the Middle East, now on its eighth edition.

The past seven PPIE editions made history in the UAE and the Gulf region by bringing in over 24,500 quality visitors.

Every Overseas Filipino dreamt of having his or her own dream house. As a matter of fact, buying a property is considered one of their first major investment as it is considered the most secured and profitable. Based on recent reports, the Philippine economy is bouncing back from a slowdown induced by the Covid-19 pandemic, and the outlook for the real estate market is significantly improving. Here are some of the top reasons why you should buy the property now.

1. Low prices and flexible payment terms

To attract buyers, the real estate developers are offering never-before-seen discounts and flexible payment terms for a limited period.

“Real estate developers are offering never before seen discounts and stretched payment terms. However, as the world starts to open up, we will not see these offerings anymore,” said, Manny Arbues, Regional Head for the Middle East and Africa of Ayala Land International.

Manny Arbues, Regional Head for the Middle East and Africa of Ayala Land International

“Real estate investment is the most resilient and tangible investment one can have particularly during this time,” Arbues added.

2. Better connectivity: Best for WFH or Online school

Developers are offering spaces to work and better internet connectivity for remote working comfort or attending online school. They are upgrading their services to attract more tenants to their facilities, such as free housekeeping and laundry services, and a stable internet connection.

Charyna Francisco, Sales Activation Head of Federal Land, Inc.

“Internet connectivity has improved because of the higher demand and need for a better-quality signal. Most homes are now connected to FIBR wifi systems,” said Charyna Francisco, Sales Activation Head of Federal Land, Inc.

3. Bounce back in economy

The country’s economy maintained its growth momentum in the first three months of 2022 as it expanded by 8.3 per cent, beating forecasts.

“The Philippine residential real estate segment will experience a rebound in 2022, primarily due to the strong domestic consumption brought about by the opening up of businesses due to the easing of restrictions. Q1 2022 GDP posted growth of 8.3 per cent with OF (Overseas Filipino) remittances reaching USD 8.7B, which is 2.3 per cent higher compared to the same period last year,” Arbues, said.

4. Rise in remittances from overseas Filipinos

The rising inflow of remittances from overseas Filipino workers (OFWs) according to Colliers will spur growth in residential demand. Data from the Bangko Sentral ng Pilipinas (BSP) showed remittances in September 2021 reached $2.7 billion (P135 billion), up 5.2 per cent YOY. For 2022, BSP forecasts a 4 per cent growth in remittances.

“The continuous flow of remittances from Filipinos abroad has also increased economic outlook,” Arbues, said.

5. Improvement in market sentiment

The market sentiment is improving and rents are pushing back to their pre-Covid levels as a result of reopening borders, the recovery of the labour market, higher vaccination rates, and return-to-office programs.

According to a report from real estate services company – Colliers Philippines, the recovery of residential prices gathered speed along with the better-than-expected performance of the economy beginning in Q3 2021, encouraging an increase in residential transactions. Property developers are looking to capitalise on the change in the economic outlook.

6. Better road and rail connectivity

Better road and rail connectivity has given buyers more options. Despite the pandemic, the government has developed major roads, railways, airports, and the country’s first subway system, leading to better connectivity between urban and rural areas. This has given buyers more options to look beyond the metro also.

Better road and rail connectivity has given buyers more options. Despite the pandemic, the government has developed major roads, railways, airports, and the country’s first subway system, leading to better connectivity between urban and rural areas. This has given buyers more options to look beyond the metro also.

“The launch of new bridges, including the Skyway 3, has helped speed up travel from Northern Luzon to Southern Metro Manila,” said, Charyna Francisco.

7. Improvement in residential condominium leasing

Residential condominium leasing has also seen a slight improvement with a 2 per cent decrease in vacancy in Metro Manila in Q1 2022, according to a report from Colliers. With more companies increasing their workforce to report on-site more employees will be encouraged to rent a condominium unit or co-living facility close to their offices.

“Rental income is the best passive income for OFWS as there are some ideal options for you to purchase as there are condominiums offered by builders at affordable rates even though they sound luxurious. It comes with perks and we can also go back and relax,” said Macario Bonifacio.

8. Co-living popular option again

Co-living will be a popular option again among employers and their workers in Metro Manila beyond 2022, especially with the return of onsite operations and the metropolis’ traffic reverting to pre-pandemic levels.

Co-living will be a popular option again among employers and their workers in Metro Manila beyond 2022, especially with the return of onsite operations and the metropolis’ traffic reverting to pre-pandemic levels.

Industry experts feel that co-living will be a popular option again among employers and their workers in Metro Manila beyond 2022, especially with the return of onsite operations and the metropolis’ traffic reverting to pre-pandemic levels.

“Co-living is common in the Metro Manila CBDs (Central Business Districts) but not limited to that – emerging markets in the suburbs where IT and BPO businesses proliferate also have co-living setups. Home buying preferences moved from co-living setups to stand-alone homes because of the need for social distancing as a result of the pandemic,” Francisco said.

9. Value of living in own home

The Property Industry like many other industries throughout the world faced challenges during the pandemic like manpower shortages and supply chain issues. The developers adapted to the new normal way of selling, marketing, and promoting their projects and managed to survive the difficult times. People realise the importance of owning a home due to the strict Covid-19 lockdown and Work From Home option. Home preferences are also changing.

The Property Industry like many other industries throughout the world faced challenges during the pandemic like manpower shortages and supply chain issues. The developers adapted to the new normal way of selling, marketing, and promoting their projects and managed to survive the difficult times. People realise the importance of owning a home due to the strict Covid-19 lockdown and Work From Home option. Home preferences are also changing.

“Earlier in the pandemic, when people started working from home, there was a strong preference for house and lot projects outside of Metro Manila, where they could be surrounded by a large expanse of open space. With the ease of restrictions where people are encouraged to go back to the office, people realise all the more the value of living in a master-planned, mixed-use, and integrated estate,” Arbues said.

10. Building compliance against Covid-19

In response to the pandemic, office buildings are being built with characteristics such as improved ventilation systems, sanitation stations, and better natural lighting. Residential apartments are now offering further technological advancements to enable people to work remotely from their homes. The need for safe living, office, commercial, leisure and industrial spaces influences the real estate industry to enable living in the new normal.

Article by: Irfan Haji

Finding a new condo in Laguna makes it an exciting experience in this bustling area of the south – whether you’re a newlywed pair or a young professional preparing to leave the home. It’s a business opportunity if you’re an investor seeking for property to add to your investment portfolio. After all, depending on your reasons for shopping for a new condo, you will also have to be mindful of the commitment to maintenance and other costs as well.

So why is Laguna sprawling and more exciting for investors and aspiring condo owners these days?

Situated some 30 kilometers south of Manila, Laguna spans a total land area of 1,823.6 km² with a population of 2.6 million. Data from the Philippine Economic Zone Authority (Peza) reveal that several companies looking to expand current operations in Laguna industrial parks – particularly companies that manufacture safety switches, semiconductors, and packaging materials.

Several Japanese companies have also committed to constructing warehouses in the South. A number of industrial developers have gained first-mover advantage in Laguna, contributing to increased residential demand in the province. A number of infrastructural initiatives are also in the works, which will help to boost industrial and residential values in Laguna.

Having said that, making smarter selections when it comes to house searching entails more than just analyzing advantages and negatives. Here are a few things to keep in mind if you’re shopping for a condo for sale in Laguna and are having trouble making a decision.

Perform an Audit. If you believe you have a list of homes that fit inside your budget, check for alternatives that provide less. Alternatively, if a house is out of your price range, consider what you may do to make it affordable. In addition, consider its monthly amortization rate and the yearly trend in the area’s appreciation rates. They’re excellent measures to examine if you’re thinking about investing in real estate.

Determine why you are purchasing a condo. As previously said, you must identify why you are purchasing a Laguna condo for sale. Do you have kids that need a lot of space? Or are you a young professional seeking for a location to call home while making a difference in the world? Perhaps you’re an investor searching for a great addition to your portfolio. When it comes down to it, your “why” will determine whether or not the decision you make is genuine. It will determine how you cope with those monthly fees as well as other roadblocks on your way to your objective.

Conduct your research. It is critical to conduct research on the type of home you wish to reside in. Begin with those that would benefit your family, yourself, or your financial portfolio the most. Access to core business centers and vital regions such as hospitals and schools must be addressed. You should also consider the property’s appreciation rate (which is frequently determined by the variables described above) and any associated expenditures. You should also conduct research on the developer with whom you may be working. This is because their reputation is similar to a brand promise, and you should be aware of what you’re entering into. You may also conduct some preliminary research on the projects they worked on, such as the landscape, facilities, and apartments within.

Listen to Your Heart. Perhaps, in addition to all of the research and practical arguments you’ve come up for yourself, there’s one more thing you should think about: your heart. In the end, if the home you pick does not resonate with you, it will be just another kind of spending. If, on the other hand, your heart is in it and you truly adore where you’re going to live, it won’t feel like another weight. Whatever your motivation for moving into a Laguna condo for sale, if you truly believe it will make you happy, it will always be the greatest decision for you.

Zadia is a 5-building condominium development by Greenfield Development Corporation. Located near the center of Greenfield City, it’s surrounded by sprawling green landscapes and functional amenities that you can take advantage of.

Atty. Duane Alexander Xavier Santos, Executive Vice President and General Manager of Greenfield Development Corporation

Atty. Duane Alexander Xavier Santos, Executive Vice President and General Manager of Greenfield Development Corporation, said that individuals who prefer living in Zadia can enjoy a living environment that’s inspired by green surroundings that’s serene and relaxing at the same time.

“We remain committed to our philosophy of creating a ‘greenspiration’ idea of condo living behind Zadia along with our other properties. We want to provide a home where residents can enjoy an abundance of green open spaces and the intricate beauty of nature to facilitate wellness and relaxation so they can live and thrive in an inspiring, sprawling sanctuary,” said Atty. Santos in an interview with Business Mirror.

According to Atty. Santos, the completion of the Cavite-Laguna Expressway (CALAX) makes traveling to and from Greenfield City to Metro Manila via the Greenfield City exit faster and more comfortable for Zadia residents, with travel time from the South Luzon Expressway to CALAX reduced from 90 to 45 minutes. Residents may now go to Tagaytay and other regions of leisure with ease and minimal traffic congestion thanks to the inauguration of the CALAX Subsection 5 from Silang East Interchange to Sta. Rosa-Tagaytay.

If you’re interested in getting a unit in Zadia, visit this web page for more information: https://greenfield.com.ph/project/zadia/. If you’d like to learn more about Greenfield City, you can visit this web page: https://greenfield.com.ph/project/greenfield-city/.

Meet Greenfield Development Corp. at the 8th Philippine Property and Investments Expo (PPIE) on 5-6 November 2022 at Crowne Plaza Hotel in Sheikh Zayed Dubai. Greenfield Development Corp. is a silver sponsor of PPIE, the biggest, longest-running and most trusted Philippine business and investment forum in the Middle East, now on its eighth edition.

The past seven PPIE editions made history in the UAE and the Gulf region by bringing in over 24,500 quality visitors.

Living in a condo doesn’t have to mean you have to skimp on space – you simply have to be clever about how you manage it! Here are a few to help you maximize each area you have at home.

Ottomans with several functions. Double-purpose ottomans are lifesavers. Aside from being elegant chairs, specialist ottomans now offer hidden storage within; ideal for your non-visible items.

Ledgers that are slim and transparent. This storage solution is ideal for individuals who like a clean and modern look in their house. For a clean look, display your beautiful collection of trinkets such as books and vases.

Bottles and jars. Don’t discard the bottled jars that were used throughout the Christmas season. You may use these jars to store household essentials like sugar, salt, and pepper.

Use every available space. Shoes, purses, clothing, and books may all be stored on freestanding shelves and cabinets. Put these shelves in the corners of your unit to save even more room.

Vertical storage. This is still a great method to add storage to your condo apartment. Hang your workplace souvenirs on the wall with metal hangers. Choose a vibrant color to add a splash of color to your house.

Select square containers. Square storage is easy to organize and match. You should have no trouble finding a place for these containers in your apartment.

Elevated platforms. Building your own elevated platform is ideal for small spaces. It may be making your own room for your bed frame or a little wardrobe. It’s a loft-style design that’s both trendy and appealing to the eye.

The Philippine Property and Investment Exhibition (PPIE), the biggest, longest-running and most trusted Philippine business and investment forum in the Middle East, is now on its eighth edition, which will be held this November 5-6, 2022 at the Crowne Plaza – Sheikh Zayed Road.

The past seven PPIE editions made history in the UAE and the Gulf region by bringing in over 24,500 quality visitors.